Continuing on through the nonfiction books of the Fulton County Public Library, I arrived in the Economics section. This category encompasses broad topics such as labor economics, financial economics, economics of land and energy, cooperatives, socialism, public finance, production, and macroeconomics. Since there is no way I could possibly cover all of those topics in one blog post I’ve chosen to concentrate on the first two-labor economics and financial economics.

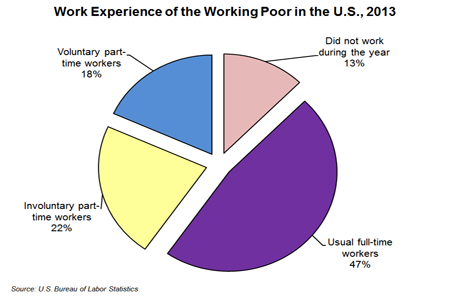

The recession that hit around 2008-2010 affected many middle class families causing hardship. Many were forced into underemployment or unemployment. Of those who were able to return to work many were unable to get a full time position or a job that paid anything but poverty wages. Most lost insurance and other job related benefits such as retirement packages. Millions of Americans now fall into a category known as the Working Poor. In 2013 this is what that looked like:

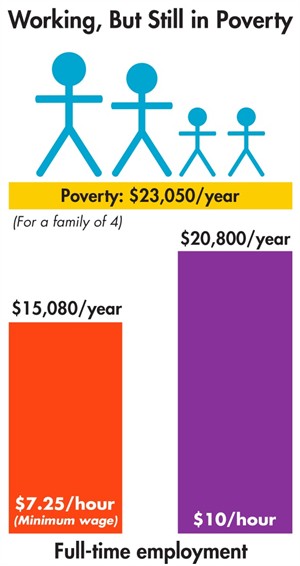

Although there have been some improvements in the economy in the last 3 years, many former middle class families still can’t make ends meet. Even with minimum wages increasing in some areas (and minimum wage going up at least $1 since the graph was made), millions of full time, hard working Americans with families still find themselves living at or below poverty level wages.

Often people are forced into working multiple jobs just to make ends meet. Many of the books I read in the Economics section focused on this issue. Even more alarming are the number of households headed by women raising children alone and the number of married women who are the main bread winners in their families but still making considerably less money than men doing the same job. The work world tends to discriminate against women with children. Particularly noteworthy books that I read dealing with these subjects follow.

This book, The Betrayal of Work by Beth Shulman, does an excellent job of describing the dead end cycle that many American families find themselves caught in. Shulman follows several full time, hard working people and describes the sorts of conditions they must deal with on a daily basis.

Selling Women Short by Lisa Featherstone is a book detailing reasons for a class action lawsuit (Dukes v. WalMart ) which exposes many labor and ethical violations in the retail sector. After reading this book, the reader will have a new appreciation for the need for change in the American workforce.

Selling Women Short by Lisa Featherstone is a book detailing reasons for a class action lawsuit (Dukes v. WalMart ) which exposes many labor and ethical violations in the retail sector. After reading this book, the reader will have a new appreciation for the need for change in the American workforce.

Brigid Schulte does a remarkable job in Overwhelmed Work, Love, and Play When No One Has the Time of exploring the balance (or lack thereof) that many people (mostly women) experience between work and leisure time. This is especially an important work when one considers that in many cases women must work extra hours just to make up pay differences or split shifts due to needing to take care of children. Although a rather long read, this book has many important points to make and is well worth the time.

Brigid Schulte does a remarkable job in Overwhelmed Work, Love, and Play When No One Has the Time of exploring the balance (or lack thereof) that many people (mostly women) experience between work and leisure time. This is especially an important work when one considers that in many cases women must work extra hours just to make up pay differences or split shifts due to needing to take care of children. Although a rather long read, this book has many important points to make and is well worth the time.

About the time I was reading these books, I was handed the following new addendum at work; author unknown.

Employee Handbook

Sick Days

We will no longer accept a doctor’s statement as proof of sickness. If you are able to go to the doctor, you are able to come to work.

Personal Days

Each employee will receive 104 personal days a year. They are called Saturday & Sunday.

Lunch Break

Skinny people get 30 minutes for lunch as they need to eat more so that they can look healthy. Normal size people get 15 minutes for lunch to get a balanced meal to maintain their average figure. Fat people get 5 minutes for lunch because that’s all the time needed to drink a Slim Fast.

Dress Code

It is advised you come to work dressed according to your salary. If we see you wearing $350 Prada sneakers and carrying a $600 Gucci bag, we assume you are doing well financially and therefore do not need a raise.

If you dress poorly, you need to learn to manage your money better so that you may buy nicer clothes and therefore you do not need a raise.

If you dress in-between, you are right where you need to be and therefore you do not need a raise.

Bereavement Leave

There is no excuse for missing work. There is nothing you can do for dead friends, relatives, or co-workers. Every effort should be made to have non-employees attend to the arrangements. In rare cases where employee involvement is necessary, the funeral should be scheduled in the late afternoon. We will be glad to allow you to work through your lunch hour and subsequently leave one hour early.

Restroom Use

Entirely too much time is being spent in the restroom. There is now a strict 3 minute time limit in the stalls. At the end of three minutes, an alarm will sound, the toilet paper will retract, the stall door will open and a picture will be taken. After your second offense, your picture will be posted on the company bulletin board under the “Chronic Offenders” category.

Thank you for your loyalty to our great company.

We are here to provide a positive employment experience.

Although I read many books pertaining to financial economics there is one that I favor above all others. It is The Total Money Makeover by Dave Ramsey.

Dave Ramsey has a common sense, no nonsense approach to money that will benefit anyone. As he says in his book, it doesn’t matter if you make $20,000 or $200,000 a year this plan will work for you. My husband and I have taken on this particular challenge and we are seeing immediate results. Mr. Ramsey first attacks some financial myths and then redirects areas of thinking. He lays out a basic plan in which participants work their way through 7 baby steps. In my opinion this should be required reading for everyone. Dave Ramsey has literally helped thousands of people improve their financial situations.

Thanks for sharing, really enjoyed this post and especially that memo from work!

LikeLiked by 3 people

Thanks for your comment and compliment! I am pleased you enjoyed this post. I believe that this is a topic in which the American public is greatly interested.

LikeLiked by 1 person

Or should be. Thank you.

LikeLiked by 1 person

Thank you.

LikeLiked by 1 person

I haven’t read Dave Ramsey’s book but believe a crucial point was to get out of debt. You tease us by telling us he makes good points but don’t give a hint as to what they are. I’ll have to check it out from the Savannah library, I guess.

Good post, as usual. I would like to add that the amount of money is not as important as the buying power of money. For instance, the price of gold in 1970 was $40/oz. Now it is up to around $1200/oz. We never really left the gold standard, as far as relative values are concerned.

Also, insurance and taxes (all taxes–not just income tax) have increased substantially, reducing the disposable income of all wage earners, but greater proportionally for those who earn the least.

While other people believe insurance is a good thing, I think it is one of the most vampiristic systems we have (other than taxes and interest on debt). Anything that must be mandated is not sustainable on its own, and insurance costs, plus mandates and subsidies, are some of the most debilitating costs we have going.

We are all subsidizing Wall Street with our payroll taxes, retirement pensions, and even working for or buying merchandise from publicly traded companies. The younger workers now paying into this payroll tax Ponzi scheme may never be able to recoup their investments. Again, if it weren’t mandatory, I wonder how many people would choose to pay. The very idea of saving for retirement seems suspect when the currency is so unstable and people can’t even meet today’s expenses.

There’s a move afloat to raise minimum wage. I claim this will merely raise the bar for everyone and force these workers and their employers to pay more in taxes. I believe everyone would benefit more if payroll taxes were made voluntary, but I can already hear Congress’ reasons for nixing that idea.

I don’t believe in paying people to boss me around, yet this is what we are doing. If the government goes bankrupt–as it seems to be trying to do– we may all begin getting priorities straight and to see what freedom really means.

LikeLiked by 2 people

The tease was intentional. I would love for people to read this book for themselves! Also, you can find the basic gist of Ramsey’s plan online just by typing his name into a search engine. I still think it’s important to read though.

You make some very good points in your reply. In my opinion, raising minimum wage isn’t going to solve the overall problem of poverty. When minimum wage goes up, retailers just raise prices and jobs are lost. We need to get to the underlying root causes and attack them at their souce. This will mean some hard decisions for everyone.

LikeLiked by 2 people

Agreed. I’ll bet “The Creature from Jekyll Island: A Second Look at the Federal Reserve” isn’t in your library. This was an eye-opening book for me, because it explains a lot about banking history and especially how the Fed works. Bottom line is the entire economy is upside down, all based on debt. This means that the central bankers create money out of thin air, which they lend to the government, which uses it to buy what it wants and pays interest (through income taxes) to the Fed for the loan.

This debt disguised as money percolates into the economy. Since it is the only legal tender, taxpayers circulate it as though it has intrinsic value, but it has none. The system only works as long as people have faith in government promises to pay.

Individuals add value through their productivity then pay a whopping amount of multiple taxes and fees–income, payroll, property, licenses, excise–on this pseudo-money.

The Fed gets perpetual interest on the debt through income taxes. The point is not to pay off federal debt. The point is to provide a constant feed to the Fed in value-added money via worker productivity.

That, to me, is the root cause. To correct the problem, taxpayers need to understand that the Fed and the government have done absolutely nothing to earn the money.

Anyone can become rich overnight if they have the authority to create money out of thin air and a monopoly on that authority.

LikeLiked by 1 person

I checked and “The Creature from Jekyll Island: A Second Look at the Federal Reserve” is in our Evergreen system. That means that it’s not physically located in our building, but we have access to it. It does sound like an interesting read. You are right about the economy being upside down. The “rules” have changed and that’s why it’s so important for people to read and educate themselves on this subject. Thanks again for very insightful comments.

LikeLiked by 1 person

Good for your library system! Ours lists many things in its electronic card catalog that are not actually available. Also, I’ve seen a slow erosion of classic history and literature books here, replaced with computers, music CD’s, movie DVD’s and other pop culture. Lots of empty space and empty shelves. I have to wonder if the most valuable books are finding their way into private collections.

You’ve inspired me to look for “Creature” here, as well as Dave Ramsey’s book.

LikeLiked by 1 person

There’s no doubt that libraries are changing. I think adding resources is great, but it shouldn’t be at the expense of the older resources.

I’m pleased to hear that you’ve been inspired to read!

LikeLiked by 1 person

I’ve always been a reader. Don’t have a television (mind pollution) and limit exposure to the (to me) surrealistic hold the electronic media has over the mass mind.

Right now, I’m reading “The House of Morgan: An American Banking Dynasty and the Rise of Modern Finance,” by Ron Chernow, about J. Pierpont Morgan and family. Now on page 85 of this 720-page tome, about the first trust (otherwise known as a “syndicate” or “cartel”), US Steel, in 1901.

LikeLiked by 1 person

The only TV we watch is in the form of DVDs from the library. It was actually a financial decision for us to turn off the TV when my husband went back to school. We don’t really miss TV. I do miss having the internet at home, however. We will hook some services back up in the near future, but even then we won’t be “connected” 24/7.

It’s kind of cool that the topic of “Economics” came up during the time you’ve been doing financial reading.

LikeLiked by 1 person

I’ve been obsessed with American history and economics for years. You may remember the reading list I posted on my blog awhile back. I think that was when you found my site.

I go through phases of reading preferences, sort of like your reading tour through your library. Since I’m so interested in the underside of current events, it helps to study the circumstances leading up to our current state.

LikeLiked by 1 person

That is always an interesting thing to do. I’ve recently learned things about the mental health system from a historical perspective and what an eye opener that has been!

LikeLiked by 1 person

I’d like to read your blog on that.

LikeLiked by 1 person

The Mental Health blog is scheduled for Aug 19th. Bear in mind I’m limited in what I can say in one blog entry, so I’m always trying to point to the best books I’ve come across on the topic.

LikeLiked by 1 person

Yay! I I have been patiently waiting for the next post from you in the library tour! And what a wonderful post it was. I read the Total Money Makeover too! I actually watch or listen to Dave Ramsey’s podcast (he has a version which you can watch him do the podcast, while I am sewing or working on craft projects. I love, love, love what he says about buying cars. I also now listen to his protege Chris Hogan’s podcast (love his voice and his addicting enthusiasm). I thought the Employee Handbook item you posted was real at first and then I started laughing – even though it is satire it seems a little too real! Thanks for a highly enjoyable post, it was worth the wait 🙂

LikeLiked by 2 people

Thanks for your enthusiastic addictive comments! 😉

LikeLiked by 1 person

I had a feeling you might be a Dave Ramsey fan, Tierney. I am not as familiar with Chris Hogan, but if he is in the “Ramsey school,” then I’m sure he’s great! I will try to keep an eye out for his books.

I’m glad the employee handbook addendum could put a smile on your face. Money is a serious topic and I think sometimes we have to lighten things up!

LikeLiked by 1 person

That work memo was hilarious but a little too close to where things seem to be headed.

LikeLiked by 2 people

You are right about that, Kourtney! Others have also commented about the satire being a bit too close to the truth!

LikeLike

Thanks for the plug!

LikeLike

When I was younger my family invested in a Dave Ramsey game…. It wasn’t the most fun, but it was educational!

LikeLiked by 1 person

What did you learn?

LikeLiked by 1 person

The game is called Act Your Wage. You would be given a random career and lifestyle. Like in reality, bills, budgets and taxes were relevant. The object of the game is to pay off all of your debt first. What I remember most from it is that it is crucial to always keep at least $1000 in the savings account. And to refurbish it when it had to be used.

LikeLiked by 1 person

The game sounds very realistic!

LikeLiked by 1 person

It is! Probably just as stressful too. ☺

LikeLiked by 1 person